Line 3a captures your qualified dividends and line 3b captures your ordinary dividends. Dividends are distributions from companies to shareholders. Most people that have reportable dividends have those dividends as a result of their stock investments.

The financial institution through which you have your portfolio should provide you with annual statements that reflect all of the dividends that your holdings have paid throughout the course of the year.

These annual statements generally contain all of the 1099s (federally required statements of their account holders’ income) copies of these 1099s must be provided to the individual and to the IRS.

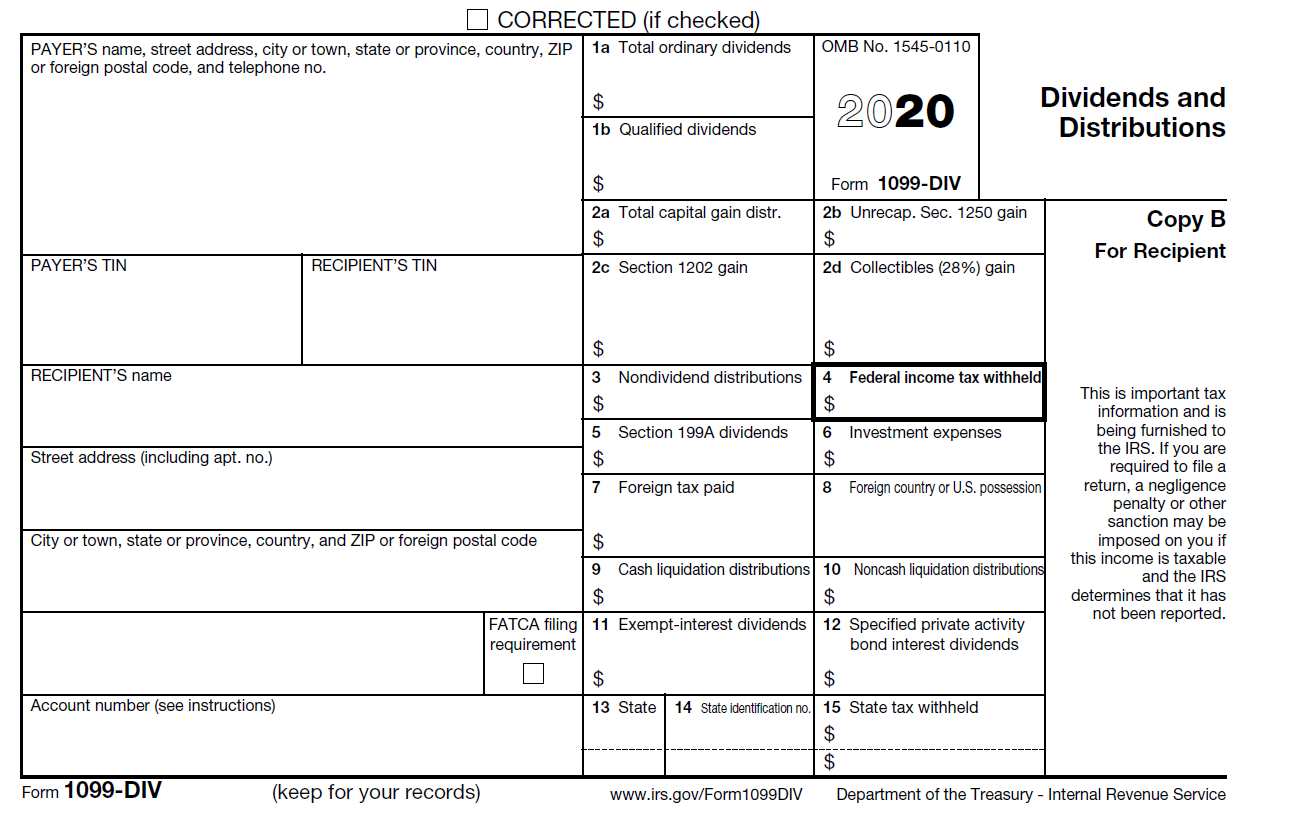

Dividends are generally reported on 1099-DIVs. This is filed with the IRS as a separate 1099, but you should note that generally all of the 1099s from the financial institution will be consolidated into the annual statement that they provide to you.

The 1099-DIV (as well as the annual statement provided to you by the financial institution) will clearly identify the amount of qualified and ordinary dividends. Your portfolio statements will separately list the dividends from each of your investments but the information provided to the IRS by the financial institution will report the amount of dividends paid to you in the aggregate for all of your investments that are held with that financial institution.

While portfolios are the most common source of dividends, they are certainly not the only source. Individuals who directly hold shares in companies, whether these companies are publicly traded on stock exchanges or privately owned, have dividend income based on the distributions that they receive from these companies.

Not all distributions from corporations are dividends. Generally when a shareholder receives distributions from a corporation, that distribution is either taxable dividend income or a return of capital. If a corporation makes distributions to its shareholders and it has current year or prior year undistributed earnings and profits, any distribution is very likely to be a dividend to the extent of the earnings and profits. If a corporation does not have any earnings and profits to distribute, then a distribution from that corporation can be classified as a return of capital. A return of capital is not taxable income unless the return of capital exceeds the remaining amount of your basis. We’ll cover basis a bit more thoroughly when we discuss Schedule D, but the short description is that your basis in any asset or investment is generally the amount that you paid for that asset less any basis adjustments. A return of capital is a basis adjustment, and receipt of a return of capital reduces your basis in the investment.

To provide an example, if you paid $100 for one share of stock in Company A in 2015, your basis in your Company A share is $100. If during 2016 Company A, after having an unusually tough year, issues a return of capital to investors of $5 per share, your basis in your company A share would be reduced to $95 and you would not include that $5 distribution in your income. As we discussed in ‘What is an What is Not Income?’, you can see that you have not had an ‘accession to wealth’ as the $5 you received is directly paired with a $5 reduction in the value of the share.

It is important to highlight that a return of capital distribution is only possible when Company A does not have earnings and profits or accumulated earnings and profits. If individuals had the ability to classify all of the distributions they received as non-taxable returns of capital, they would, but the rules only permit this classification when there are no earnings and profits. It is also worth mentioning that any distributions that are classified as ‘returns of capital’ that would reduce a shareholder’s basis to below $0, will become taxable capital gain income for the shareholder.

Now let’s step forward into 2017, after a very profitable year Company A issues a dividend of $20 per share. This $20 distribution will be classified as a dividend and will become taxable income for the shareholder. This distribution will not impact your basis in your company A share in any way.

To tie this example to the above 1099-DIV, the 2017 dividend will be listed on line 1a and line 1b, and the 2016 return of capital would have been listed on line 3.

The next questions you may have are: what are qualified and ordinary dividends, how do I report each, and what is the difference between the two? First, note that all qualified dividends will always be listed on both the qualified dividend and the ordinary dividend lines. This means that in the above example, even though $20 2017 dividend was listed on both the qualified and the ordinary dividends lines, you only had a total of $20 in total dividends. When all of your dividends are qualified dividends, the qualified dividends number will match the reported ordinary dividends number.

There are a handful of qualifications for a dividend to be treated as a qualified dividend for a particular shareholder. Generally, when the dividend is paid by a U.S. corporation, a dividend can be qualified if the shareholder meets certain holding period conditions. (see the international corner below for non-U.S. company dividends). The idea behind a ‘qualified dividend’ is that the corporation paying that dividend has already included the income that resulted in that dividend in their income and they have already paid tax on that income. Because this income has already been taxed, the tax rate that applies to these dividends for individual shareholders is reduced. Ordinary dividends are classified as ordinary income and are taxed at your marginal tax rates while qualified dividends are taxed similarly to long term capital gains income (i.e. at 0%, 15%, and 20%).

International Corner

There are two main topics of interest in the international corner for dividends, the foreign tax credit and when can foreign dividends be qualified dividends.

The first, which will be relevant to a lot of people who may potentially be unaware that they have investments generating income in foreign countries, is the foreign tax credit. Generally the amount of foreign taxes paid on dividends generated within your investment portfolio will be clearly reported on both the 1099-DIV and on the annual statements provided by the financial institution. Reporting these foreign taxes from your 1099-DIVs is generally going to be simple but if you have other foreign income or the amount of the foreign taxes paid exceeds $300 ($600 if filing jointly) then the filing will become more complicated and you will need to use Form 1116 to claim these foreign tax credits. See the article on Form 1116 here. Once you need a form 1116, you will be subject to limits on the amount of foreign tax credits you can claim and it will become important that you more carefully and more thoroughly review your annual portfolio statements when preparing your tax return. When the 1116 is required you will need to report the amount of foreign taxes paid AND you will also have to indicate the amount of the dividend that was foreign source income. Your foreign tax credits are effectively limited by the amount of U.S. tax that would be due on the income if it were U.S. source. No type of income is able to generate a current year credit that exceeds the amount of tax you would pay in the U.S. on that type of income. The actual mechanics of the 1116 get more and more complicated; see this article for a review of the 1116. (/blog/2020/10/5/foreign-tax-credits-ftcs-and-form-1116)

The second topic, when can foreign dividends be treated as qualified dividends, is fortunately fairly straightforward. For foreign dividends to be eligible to be treated as qualified dividends they must meet the same holding period restrictions as domestic dividends AND they must be issued by a corporation that is eligible for benefits under a U.S. income tax treaty. To find the up-to-date list of countries that have a treaty that qualifies their corporations for qualified dividends treatment you should check IRS Publication 17 here: https://www.irs.gov/publications/p17. At the time this article was written, table 8-1 had the list of countries whose corporations are eligible for qualified dividend status.