Line 4 and line 5 of your 1040 is for retirement distributions and it can be the source of expensive mistakes, a reflection of trying financial times, or evidence of a retirement that has been prepared for well.

There are many people that will be using their retirement accounts as a lifeline during the ongoing pandemic, and there are special options for Coronavirus related distributions. Anyone seeking more detail on these specific rules should see Coronavirus-related Retirement Distributions - An Overview.

Lines 4 and 5 capture all distributions from your retirement plans, whether they are rollovers, taxable distributions, or non-taxable distributions.

During 2019, this line was subdivided into four sections, 4a reports the total IRA distributions, 4b reports the taxable IRA distributions, 4c reports the total pension and annuity distributions, and 4d reports the taxable portion of the pension and annuity distributions. On the 2020 1040 these fields are instead subdivided into line 4a, line 4b, line 5a, and line 5b

These lines need to be used to report distributions from Roth accounts and from Traditional accounts, which means Lines 4a and 4b capture both Roth IRA and Traditional IRA distributions. Lines 4c and 4d capture the retirement distributions that aren’t from IRAs. This means that all distributions from 401(k)s (whether they are traditional or Roth 401(k)s) will be reported on lines 4c and 4d.

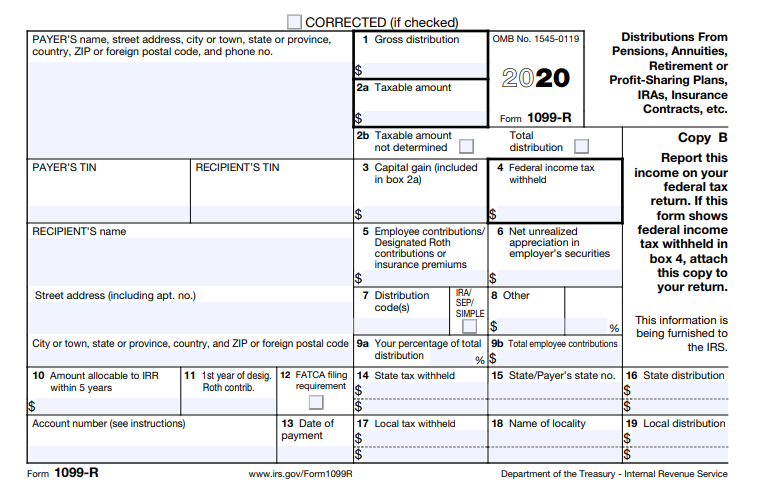

Regarding what is and what is not taxable, the best place to start is always with the 1099-R provided to you from the financial institution, but this should never be the end of your review of these distributions. Mistakes can be made by the financial institutions on the 1099-Rs and it is important that you have an understanding of when a distribution should and when it should not be taxable.

Let’s take the somewhat complicated example of a Roth 401(k) that Taxpayer maintains through her employer. Roth 401(k) accounts that have an employer match have that match provided into a segregated 401(k) account, as the employer contributions are not Roth. This means that Taxpayer’s Roth 401(k) is going to have 3 separate components that she will need to track to accurately characterize the taxability of distributions.

First, she will need to know the amount she contributed to the Roth 401(k), she will need to know the amount of the employer match, which funds a traditional 401(k), and she will need to know the amount of growth on the portion that she contributed.

In a perfect world, she would be able to log in to her employer sponsored retirement account and acquire all of this information, but, unfortunately, for many retirement providers these details will not be readily available. Now, she can review her W-2s for each year or her pay stub records to calculate these amounts herself, but that might be quite the task, requiring the preservation of documents from many years ago. This will again leave her in the position of having to trust the numbers provided by the financial institution, but, she should have a reasonable sense of the amount she contributed and based on that, she should be able to estimate the employer match based on her company’s match policy.

During 2018 Taxpayer moves to a different employer and she rolls her 401(k) plan from her prior employer’s plan to her current employer’s plan. The entirety of this distribution will be listed on line 4c but none of this distribution will be included on line 4d. This rollover does not change the character of any of those three different balances that she was previously tracking.

During 2019, despite Taxpayer being several years away from retirement age, she wants to utilize her 401(k) retirement funds to remodel her home. At the time of the distribution her retirement account had a total of $12,960. She knows that she contributed $6,000 and that based on her employer’s matching policies that the employer would have contributed $4,800. This means that the account has had $2,160 of growth. If this distribution occurred after she had reached retirement age, we would need to know which gains were based on her contributions and which gains were based on the employer match, but because this is an early distribution, both of those segments of her 401(k) will be taxed in the same way. This results in a line 4c total distribution of $12,960 and a line 4d taxable distribution of $6,960.

Whenever you have early distributions from a retirement account, you can safely begin with the assumption that all of the distributions will be taxable and then proceed to make adjustments for any Roth contributions that you have made to that account. The growth associated with the Roth contributions will still be taxable as well, which means you need to know how to determine what portion of the Roth account is growth and what portion is employee contributions. You should also note that your plan provider may only list the full value of the Roth account as ‘employee contributions’ and the full value of the traditional component as ‘employer contributions’. This can be particularly misleading for individuals that expect the full amount of the contributions to not be subject to tax, when, after taking an early distribution, she finds that more of the distribution was taxable than she expected.

The tax treatment changes a bit when the distributions occur after she reaches retirement age, meaning they aren’t early distributions. When the distributions occur after retirement age has been reached, the Traditional 401(k) distributions are still entirely taxable, but the Roth 401(k) distributions are not taxable. This means that the Roth growth that is taxable with an early distribution, ceases to be taxable income once the individual reaches retirement age(typically 59 ½ but there are exceptions).

Hopefully this example has highlighted the importance of understanding the expected tax consequences for retirement distributions. If the plan provider incorrectly reports these amounts you could end up overpaid on taxes, or potentially equally significantly, you could end up underpaid and subject to correction by the IRS in the future, subjecting the unpaid tax amounts to additional interest and penalties.

Understanding a 1099-R isn’t as simple as the 1099-DIV and the 1099-INT that we have discussed in previous articles.

As we mentioned above, it’s important that you understand the amount of any distribution that should be taxable, and that you confirm this expectation matches the 1099-R that you receive. When you’re reviewing a 1099-R, the two most important lines are normally box 1, box 2, and box 7. Box 1 and box 2 respectively reporting the total amount distributed and the amount of that distribution that is taxable income.

There are also fields that report the amount of federal/state/local tax that you opted to withhold from your retirement distributions.

The last box that I will draw your attention to is box 7. Box 7 is the distribution code box, and this is the box that will describe the nature of the distribution. This box can be used to indicate a number of different things about the distribution, but the most common examples of information relayed through this box are: normal distribution, early distribution, rollover, and Roth distribution. The 1099-R that you receive should have a list of all of the codes that can be reported in this box, but you can also find these codes in the 1099-R instructions on pages 7 and 9 of this PDF: https://www.irs.gov/pub/irs-pdf/f1099r.pdf.