This is not the most exciting income line on the 1040 but it is one of the most commonly used lines. As you would imagine based on the title, this line is where you report the income associated with your employment. This line captures all of the income that is included on your W-2 and can capture some income amounts that are associated with your employment but that were not included on your W-2. This line will capture your employment income whether you are a full time hourly employee, a salaried employee, or even a part time employee.

A W-2 is the form that your employer will provide to you during January to report the income information associated with your work for that employer during the prior tax year. Keep in mind that your employer is also filing a copy of this W-2 with the IRS, which means if there are any discrepancies between what you received and what was reported on your W-2, this is something that is going to need to be addressed. Start this process by discussing it with your employer in an attempt to have them provide you with a corrected W-2.

The 1040 indicates that you should attach a copy of all of your W-2s to your return. In years gone by, this would have been satisfied by actually affixing one of the copies of the W-2 provided to you by your employer, to your tax return. In the modern age of electronic filing, this is no longer the case. Instead of affixing your W-2, you or your tax preparer will input all of the relevant information from your W-2 into the tax preparation software and the software will generate a statement that contains the required details from your W-2.

State tax returns generally require special information that may not be required for the calculations on the federal. Generally speaking you just need to confirm that you put all of the W-2 details into your tax software.

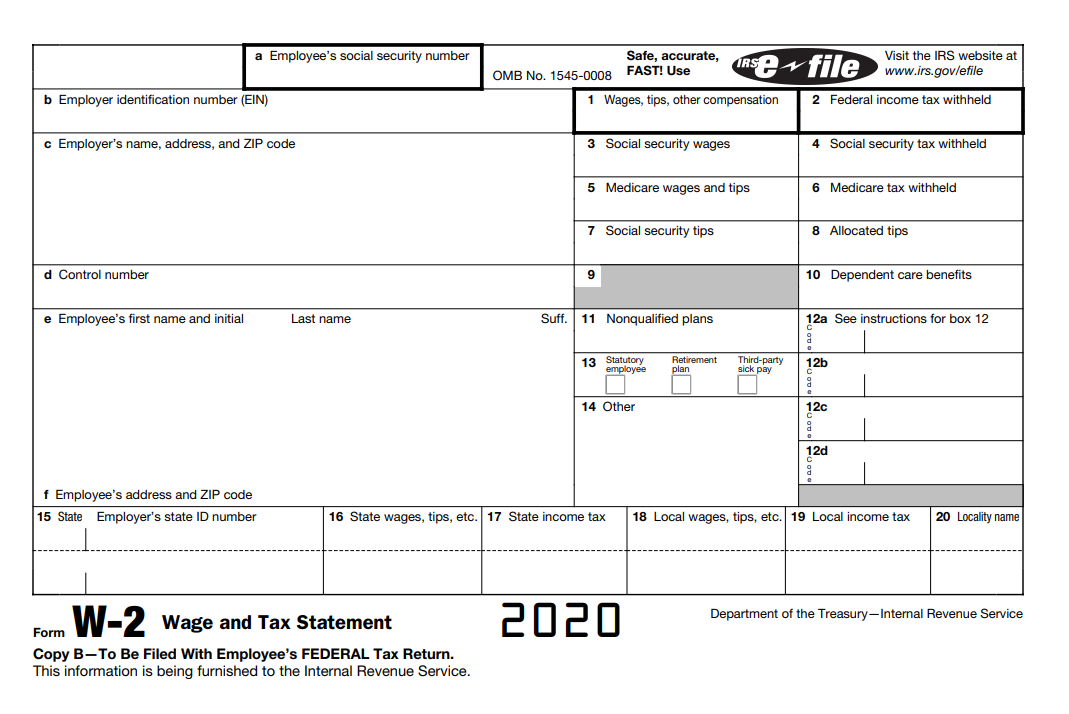

Many of the boxes on the W-2 can have a direct impact on your return.

Box 1 will generally be the amount of wage income reported on your return.

Box 2 is the amount that your employer paid to the federal government out of your wages (this amount is set when you complete a W-4 with your employer).

Box 4 is the amount of Social Security tax paid from your wage. There is a cap to the amount of wages that can be subject to Social Security tax, which occasionally leads to social security taxes being overpaid in years that an individual works for two or more employers.

Box 6 is the amount of Medicare tax paid out of your wages.

Box 7 reflects the amount of tips you reported to your employer and this amount should already be included in Box 5 and the associated withholding should be in Box 6.

Box 8 ‘Allocated Tips’ are not included in Box 1, 3, 5, or 7, and will need to be added to your wage on line 1 of the 1040, unless you can demonstrate (typically with a daily log) that you received less in tips than your employer allocated to you.

Box 10 includes any dependent care (i.e. daycare) benefits provided by or paid for by your employer for you, to the extent that these benefits exceed $5,000, they should be included in Box 1 already and you can file Form 2441 to determine the taxable amount.

Box 12 captures a large variety of different transactions through your employment, most commonly things like the cost of employer-sponsored health coverage, 401(k) contributions, and the taxable cost of group-term life insurance.

Box 15-20 is used to report state and locality (i.e. city) specific information including the wages sourced to that state/locality, and tax paid to that state/locality. You will need a separate set of Box 15-20 information for each state you worked in for that employer.

Tips, Servers, Restaurants and Bars

It’s worth taking a second to go through how tip income is handled, as always, if this isn’t relevant to you (or you don’t find it genuinely interesting, because…. well…. It is) feel free to skip sections like this.

When you work in an environment in which customers are tipping you (i.e. waitress/waiter), you need to report the amount of tips that you receive to your employer. Your employer is going to include those tips on your W-2, and they are also going to include those tips when they determine the amounts that they need to withhold to the government from your check. You’ll note that there are a few boxes on the W-2 specific to tips, specifically Boxes 7 and 8. Your employer has to compare the amount of tips reported by staff against their total amount of money received from customers (i.e. total food/drink sales). If the total amount of tips is less than 8%, the employer has to ‘allocate’ tips to the servers in addition to the tips that they reported to the employer. These allocated tips appear in Box 8 of the W-2 and there is a presumption that these amounts will need to be added to your income for income tax, social security tax, and medicare tax purposes. You have the ability to dispute this determination, but you better be prepared to offer evidence that supports your claim. This evidence typically takes the form of a daily log of tips, so, if you are a server and you aren’t presently keeping this type of log, you should consider keeping one. The IRS recommends using Form 4070A to keep that daily log.

It’s also worth mentioning that the built-in gratuity applicable to large parties, is not considered a tip to the server and is instead considered a service charge. To the extent an employer gives these automatic gratuities to their employees, they will include these amounts in employee income.

International Corner

When you are working for a foreign employer, you still have to include your wages on line 1 of your 1040. The actual amount included and the taxes ultimately paid on those amounts in the U.S. is going to vary wildly by country and based on your specific circumstances.

The first question is: what amounts have to be included as my ‘foreign wages’? Well, this question doesn’t have a simple answer and you will often have to consult the relevant tax treaty to determine what components need to be included(see this article on applying tax treaties). For starters, you will include the gross wage (including the tax paid/withheld to the foreign government). Very often you will have to add back any amounts that are deductible in the foreign country as well (i.e. contributions to your foreign retirement plan by you or your employer will normally have to be included).

In terms of what amounts will become taxable, that is a bit more complicated as well because generally you will be eligible for the foreign earned income exclusion (you can exclude roughly 100k from your income per person per year when you are living and working in a foreign country) and/or the foreign tax credit (you can claim a credit on your U.S. tax return for income taxes that you had to pay to a foreign country on your foreign source income). See this article for more information on the Foreign Earned Income Exclusion “Form 2555 The Foreign Earned Income Exclusion” and this article for more information on the Foreign Tax Credit “Foreign Tax Credits (FTCs) and Form 1116”.