Line 6 of the 2020 Form 1040 is used to report your Social Security income. Much like retirement income on line 4 and line 5, line 6 is split into a taxable and nontaxable component, unfortunately it is not as easy to determine when Social Security benefits for a particular year will and won’t be taxable.

Reporting your Social security income starts with the SSA-1099 that you receive:

This is a form that will be provided to you annually for any year during which you received Social Security income. The amount in box 5 of the SSA-1099 will serve as the starting point for line 6a of your 1040.

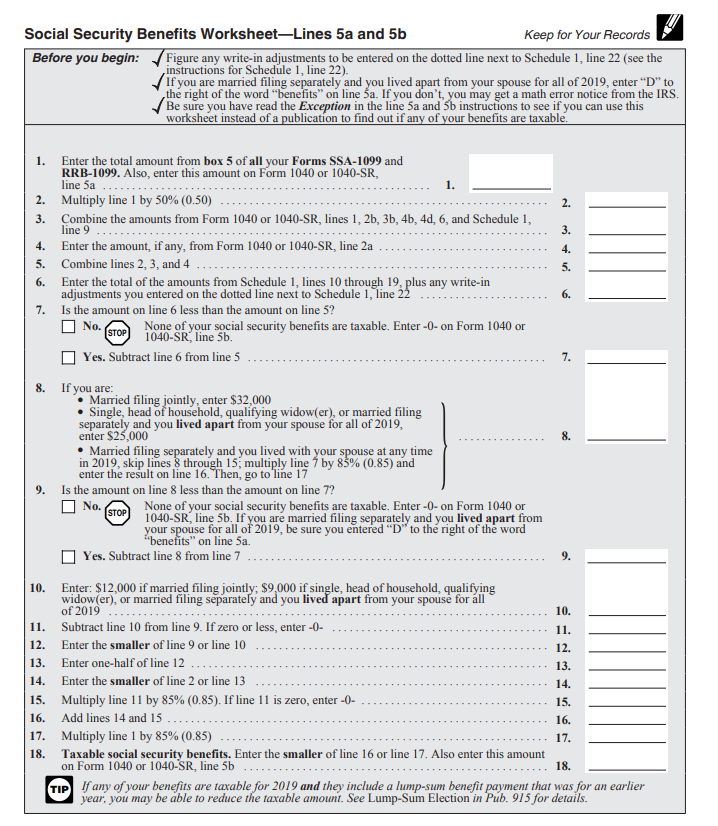

The IRS Form 1040 instructions (https://www.irs.gov/pub/irs-pdf/i1040gi.pdf) provide guidance on how to calculate the amount of your social security benefits that will be taxable income for you. Most individuals will use the following table:

Generally speaking, whatever tax software you are using to prepare your return will automatically perform these calculations.

The maximum amount of your Social Security benefits that can become taxable income for you is 85% of the amount of the benefits. These calculations are heavily dependent on your filing status and your other income.

To give you a couple of examples:

a single individual earning $100,000 of other income and $20,000 of Social Security income, would include $17,000 of that Social Security income as taxable income (85%).

A single individual earning $40,000 of other income and $20,000 of Social Security income, would include $17,000 of that Social Security income as taxable income (85%).

A single individual earning $30,000 of other income and $20,000 of Social Security income, would include $9,600 of that Social Security income as taxable income (48%).

A single individual earning $18,705 of other income and $20,000 of Social Security income, would include $0 of that Social Security income as taxable income (0%).

As you can see from the above examples, the taxability of Social Security income changes from the maximum amount of 85% to 0% in a small range. A roughly $20,000 difference in total income can result in a change from maximum amount taxable to entirely untaxable. Do keep in mind that the amount taxable is not the rate of tax applied. Once you have determined the amount that will become taxable, it will be included with your other income to determine your effective tax rate.

International Corner

Folks living outside of the U.S. generally have a lot of questions relating to their Social Security. I’ll hit on a few of these common questions here. If you live outside of the U.S. you are still eligible for Social Security payments. You can have your Social Security payments deposited directly into a foreign account. The basic principles of the calculations regarding taxable income are the same as they are for individuals living within the U.S. but, if you are earning a foreign wage and claiming the foreign earned income exclusion (FEIE), then you have to use a different worksheet for the Social Security ‘taxable income’ calculations. A different worksheet is required because the excluded income still needs to factor in when determining the amount of Social Security income that is included as taxable income. It’s also worth noting that you cannot use your foreign earned income exclusion to exclude any of your Social Security income.

I don’t want to stray too far from the discussion of Social Security income, but there are some important details relevant to individuals working outside of the U.S. in terms of payments into Social Security. If you work for a foreign employer (and you are an employee) then you generally will not be paying into U.S. Social Security. If you are self-employed while living and working in another country, you may or may not have to pay into U.S. Social Security. This determination will be made by reviewing the totalization agreement with the country of residence (totalization agreements can be found here: https://www.ssa.gov/international/agreements_overview.html) This link has a lot of useful information concerning the application of these totalization agreements.